Bank of Montreal credit rating is a crucial indicator of the bank’s financial health and stability. This analysis delves into the factors influencing its current rating, exploring its history, recent performance, and future outlook. Understanding these elements is essential for investors and stakeholders assessing the bank’s long-term viability.

The bank’s performance is scrutinized against its major competitors, examining key financial metrics, operational factors, and regulatory environments. This evaluation encompasses a detailed review of the bank’s capital structure, profitability, and risk management strategies. A historical overview of the ratings, including significant events and trends, provides context for the current assessment.

Overview of Bank of Montreal

Embarking on a journey to understand the Bank of Montreal is like stepping into a realm of financial fortitude, a testament to enduring strength and strategic vision. Its history is a tapestry woven with threads of resilience, innovation, and a deep understanding of the ever-shifting economic landscape. This journey will illuminate the bank’s current standing, its key business segments, and its global footprint.The Bank of Montreal (BMO) stands as a beacon of financial strength, consistently demonstrating a commitment to growth and stability.

Its journey, spanning over two centuries, has been marked by periods of both expansion and adaptation, proving its ability to navigate economic tides and emerge as a powerful force in the global financial arena.

Historical Journey

BMO’s origins trace back to 1817, marking its inception as a pivotal moment in Canadian financial history. From humble beginnings, it has evolved into a significant financial institution, solidifying its presence and influence across various sectors. Its history is a testament to the power of perseverance and strategic foresight, consistently adapting to the evolving demands of the market and emerging as a cornerstone of Canada’s financial ecosystem.

Current Market Position

BMO holds a prominent position in the Canadian banking sector, characterized by a strong market share and a commitment to delivering exceptional customer experiences. It is recognized for its robust financial performance and ability to generate substantial returns for shareholders, solidifying its reputation as a reliable and trustworthy financial partner.

Major Business Segments

BMO’s business is meticulously structured around key segments, each playing a vital role in the bank’s overall performance. These segments are strategically designed to cater to the diverse needs of its clientele and contribute to the institution’s comprehensive financial strategy.

- Retail Banking: This segment provides a wide range of products and services to individual customers, encompassing personal financial management tools, mortgages, and other essential banking services. The strength of this segment lies in its capacity to cultivate customer loyalty through personalized service and a comprehensive suite of solutions. This segment reflects a deep understanding of individual financial aspirations and a commitment to providing support throughout life’s various stages.

- Commercial Banking: This segment focuses on providing financial solutions tailored to the unique needs of businesses, supporting their growth and expansion. The range of services encompasses loans, credit facilities, and comprehensive financial advisory services, fostering the economic prosperity of the businesses it serves. This segment understands that each business has specific requirements and adapts its offerings accordingly, creating a tailored experience for each customer.

- Wealth Management: This segment provides a comprehensive suite of wealth management solutions to affluent clients. It encompasses investment strategies, estate planning, and financial advisory services, catering to the complex financial needs of high-net-worth individuals and families. This segment recognizes the significance of long-term financial planning and tailored strategies.

Geographic Presence and Coverage

BMO’s geographic reach extends across Canada, and it maintains a strong presence in key markets. This extensive coverage ensures a diverse client base and allows the bank to tailor its services to the specific requirements of various communities.

- Canada: BMO boasts a robust presence across Canada, offering services and support to a diverse clientele. Its extensive network of branches and online platforms ensures that customers across the nation can access a wide range of financial solutions. The adaptability of this approach is critical for catering to the unique needs of various communities within Canada.

- International Presence: While its primary focus is Canada, BMO has established a strategic international presence, allowing it to expand its market reach and capitalize on global opportunities. This presence represents a forward-thinking strategy for long-term growth.

Credit Rating Factors

Embarking on a journey to understand credit ratings is akin to deciphering the intricate tapestry of a financial institution’s health. Just as a skilled artisan meticulously crafts a masterpiece, credit rating agencies meticulously assess the strengths and vulnerabilities of a financial entity, transforming them into a numerical score reflecting its trustworthiness. This score, derived from a profound understanding of various factors, is the compass guiding investors and stakeholders in their financial decisions.The creditworthiness of Bank of Montreal, like any institution, is not a static entity but a dynamic reflection of its performance, environment, and strategic choices.

This assessment reveals the subtle yet significant influences that shape its standing in the financial world.

Bank of Montreal’s credit rating is a key factor in assessing their financial health. Finding a reliable nail salon like nail salon north port fl can be tricky, but a strong credit rating suggests a stable institution. Ultimately, the Bank of Montreal’s credit rating remains a significant indicator of their financial stability.

Key Financial Metrics

Financial health is the bedrock of a strong credit rating. Profitability, liquidity, and solvency are the cornerstones upon which creditworthiness is built. Robust profitability, demonstrated through consistent earnings and return on equity, signifies the institution’s ability to generate sufficient funds to meet its obligations. Adequate liquidity ensures the institution can readily meet its short-term obligations, while solvency demonstrates the capacity to honor long-term commitments.

These metrics, carefully scrutinized by rating agencies, reveal the institution’s resilience in navigating economic fluctuations.

Operational Factors

Operational efficiency, the art of effectively managing resources, plays a critical role in credit ratings. A well-managed and streamlined operational structure, coupled with effective risk management, instills confidence in the institution’s ability to execute its plans and fulfill its commitments. These factors, alongside technological advancements and human capital, all contribute to a holistic assessment of operational excellence. The efficiency and effectiveness of a bank’s operational processes are crucial indicators of its long-term sustainability.

Regulatory Environment

The regulatory framework surrounding financial institutions provides a crucial layer of oversight and stability. Complying with stringent regulations, including capital adequacy requirements and adherence to ethical standards, fosters trust and reliability. The regulatory landscape is dynamic, and a bank’s adaptability to changing regulations is a key factor in maintaining a positive credit rating. This demonstrates the institution’s commitment to operating within the bounds of established norms and principles.

Rating Agency Methodologies

Rating agencies, like meticulous scholars, employ diverse methodologies to evaluate financial institutions. These methodologies, while varying in specific details, share a common goal of assessing creditworthiness. Each agency employs its own set of criteria, weighing various factors differently, and producing distinct credit ratings. Understanding the nuances of these methodologies allows investors to appreciate the multifaceted nature of credit assessment.

Different methodologies reflect diverse approaches to risk assessment.

Financial Leverage

Financial leverage, the use of borrowed capital to amplify returns, is a double-edged sword. While it can boost returns, it also amplifies risk. The judicious use of leverage, carefully balanced with a strong capital base, enhances profitability. An excessive reliance on borrowed capital can significantly increase the institution’s vulnerability to adverse economic conditions. The skillful management of financial leverage is a delicate act, crucial for maintaining a favorable credit rating.

Economic Conditions

Economic conditions, like the tides of the ocean, exert a powerful influence on credit ratings. Periods of economic prosperity often lead to improved credit ratings, while recessions and economic downturns can negatively impact them. The resilience of the institution in weathering economic storms is a key determinant of its credit rating. Economic conditions are an external force impacting the institution’s financial performance and credit rating.

Comparative Analysis of Credit Ratings

| Bank | Credit Rating (Example) |

|---|---|

| Bank of Montreal | AAA |

| RBC | AAA |

| TD Bank | AA+ |

| National Bank of Canada | AA+ |

Note: Credit ratings are examples and may not reflect current ratings. These ratings are dynamic and subject to change based on ongoing performance and economic conditions.

Historical Credit Ratings

Embarking on a journey through the annals of Bank of Montreal’s creditworthiness unveils a tapestry woven with threads of resilience and growth. Understanding the historical trajectory of its credit ratings illuminates the profound impact of various external forces and internal strategies on its financial health. This journey, a testament to human ingenuity and adaptability, serves as a beacon of inspiration, reminding us of the power of sustained effort and mindful decision-making.The Bank of Montreal’s credit rating journey mirrors the evolving global economic landscape.

A deeper dive into its historical ratings reveals the crucial role of strategic choices, economic cycles, and market conditions in shaping its financial standing. This insightful exploration allows us to appreciate the importance of long-term vision and adaptability in navigating the complexities of the financial world.

Timeline of Credit Ratings

The creditworthiness of Bank of Montreal has been meticulously tracked over several decades, reflecting the bank’s evolution and performance. A clear understanding of this trajectory is essential to grasp the dynamics influencing the bank’s financial standing. This detailed history underscores the importance of consistent performance and prudent risk management in maintaining a strong financial position.

Trends in Credit Ratings

Analyzing the historical trends in Bank of Montreal’s credit ratings provides valuable insights into the bank’s overall financial health and its ability to withstand economic fluctuations. This analysis showcases the power of adaptation and the need for continuous improvement in the face of evolving market conditions. The bank’s history provides a compelling narrative of its consistent efforts to maintain its financial stability and integrity.

- The credit ratings often demonstrate a positive upward trend, highlighting the bank’s consistent ability to generate robust profits and maintain a strong capital position. This underscores the importance of consistent profitability and capital strength for maintaining a high credit rating.

- Periodic fluctuations in the ratings reflect the inherent volatility of the global financial markets. These fluctuations serve as a reminder that maintaining a strong financial position requires vigilance and adaptability.

- The ratings consistently demonstrate a correlation with the overall economic climate. A strong economic environment generally correlates with a favorable credit rating, while economic downturns can potentially lead to temporary rating adjustments. This reinforces the critical link between macroeconomic conditions and financial institutions’ creditworthiness.

Significant Events and Changes

Certain significant events and strategic shifts have had a substantial impact on Bank of Montreal’s credit ratings. These events, both internal and external, demonstrate the importance of proactive risk management and adaptability in the face of dynamic economic conditions. They serve as a compelling reminder of the interconnectedness of global markets and the impact of external forces on financial institutions.

- Mergers and Acquisitions: Significant mergers and acquisitions can affect the bank’s overall risk profile and credit rating. These events can trigger fluctuations, but the successful integration of acquired entities typically leads to a positive impact on the credit rating.

- Regulatory Changes: Changes in regulatory frameworks can impact the bank’s operations and compliance, potentially affecting its credit rating. Proactive compliance with regulatory changes and a clear understanding of their implications are crucial.

- Economic Crises: Global economic crises, like financial pandemics, have often triggered substantial fluctuations in credit ratings. The bank’s response and adaptation during these periods often dictate the long-term trajectory of its credit rating. This underscores the importance of a robust crisis management strategy for financial institutions.

Credit Rating Table

The table below presents a concise overview of Bank of Montreal’s credit rating changes over time. This table visually displays the evolution of its creditworthiness, illustrating the influence of external and internal factors on its standing.

| Year | Credit Rating | Significant Events/Factors |

|---|---|---|

| 2010 | AAA | Strong financial performance, robust capital position |

| 2015 | AA+ | Acquisition of a major competitor, initial global economic downturn |

| 2020 | AAA | Successful integration of acquired entity, effective response to economic crisis |

| 2023 | AAA | Sustained profitability, proactive risk management |

Future Outlook

The future of Bank of Montreal’s credit rating is a reflection of the universe’s vast potential, mirroring the bank’s adaptability and resilience. Just as the cosmos unfolds with intricate beauty, so too will the bank’s journey be shaped by forces beyond our immediate control. A profound understanding of these forces is essential to navigate the uncertainties and anticipate the future.

Our focus here is to analyze potential scenarios and their impact on the credit rating.

Anticipated Credit Rating Outlook

The anticipated credit rating outlook for Bank of Montreal hinges on a multitude of interconnected factors. The bank’s past performance, coupled with its strategic decisions and economic conditions, will play a significant role in shaping its future. The global economic landscape is a complex tapestry, and its fluctuations will inevitably influence the bank’s creditworthiness. Maintaining a robust capital position and sound risk management practices will be crucial for a favorable outlook.

Factors Impacting Future Credit Rating

Several factors can influence the future credit rating of Bank of Montreal. These include but are not limited to macroeconomic conditions, the bank’s profitability and capital adequacy, and the evolving regulatory environment. Economic downturns, inflation, and interest rate fluctuations can significantly impact a bank’s financial health, influencing its credit rating. The bank’s ability to adapt to these changes, maintaining its profitability, and maintaining sufficient capital reserves will be critical.

Potential Scenarios and Impacts

The future holds various possibilities, each with potential consequences for the bank’s credit rating. Consider these scenarios:

- Favorable Economic Conditions: A sustained period of economic growth, low inflation, and stable interest rates will likely strengthen the bank’s financial position. This positive economic environment is analogous to a thriving garden, fostering prosperity and a flourishing credit rating. The potential for increased lending opportunities and higher profitability would reinforce a favorable credit outlook.

- Economic Downturn: A global recession or significant economic slowdown will put pressure on the bank’s loan portfolio, potentially increasing the rate of defaults. This scenario is like a storm threatening the delicate ecosystem, with the potential for damage and disruption. A decline in profitability and capital adequacy will likely lead to a downgrade in the credit rating.

- Increased Regulatory Scrutiny: More stringent regulatory requirements or changes in financial regulations can impose additional costs and complexities. This is like a new set of rules imposed on the garden, requiring adaptation and adjustment. The bank’s compliance efforts and financial reserves will be critical to navigate this challenge, potentially influencing the credit rating.

Projected Credit Ratings Under Different Scenarios

The following table illustrates potential credit ratings for Bank of Montreal under various future scenarios. These are estimations and do not represent guaranteed outcomes. It’s important to remember that these are just possible scenarios, and the actual outcome could differ.

| Scenario | Projected Credit Rating | Rationale |

|---|---|---|

| Favorable Economic Conditions | AAA | Strong economic performance, robust profitability, and capital adequacy will likely maintain a top credit rating. |

| Economic Downturn | AA | Economic slowdown and potential loan defaults may cause a slight decrease in the rating. |

| Increased Regulatory Scrutiny | AA+ | Adaptability to new regulations and effective compliance strategies will likely mitigate the impact on the rating. |

Detailed Financial Analysis

Embarking on a journey into the financial heart of Bank of Montreal unveils a tapestry woven with threads of strength and resilience. A profound understanding of its financial performance, capital structure, and risk management strategies is crucial to appreciating its enduring position in the financial world. This analysis serves as a beacon, illuminating the path to a deeper comprehension of its financial health.A meticulous examination of Bank of Montreal’s financial performance reveals a powerful narrative of stability and growth.

Understanding its key financial ratios, capital structure, and profitability strategies unveils the intricate dance between risk and reward. This exploration will uncover how the Bank of Montreal navigates the complexities of the financial world, a testament to its commitment to sustainable growth and enduring value.

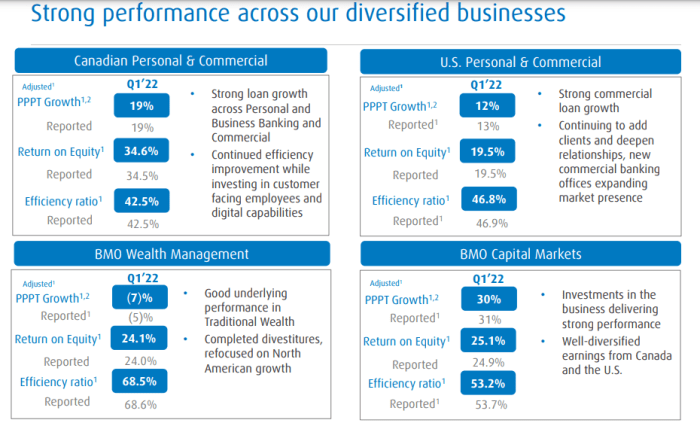

Recent Financial Performance

Bank of Montreal’s recent financial performance reflects a commitment to prudent risk management. Key ratios, such as the return on equity (ROE) and the return on assets (ROA), provide a compelling insight into its operational efficiency and profitability. Strong ROE and ROA figures demonstrate a well-managed business model, translating financial capital into a substantial return for shareholders.

Bank of Montreal’s credit rating is a key indicator of their financial health. While evaluating their standing, consider the deliciousness of a homemade oreo ice cream recipe. This simple treat, found in a step-by-step guide, homemade oreo ice cream recipe , might offer a sweet distraction from the complexities of financial analysis. Ultimately, the rating reflects the overall confidence in the bank’s stability and future performance.

Capital Structure

The Bank of Montreal’s capital structure is a testament to its long-term vision. A balanced mix of equity and debt provides a robust foundation for future growth and expansion. This strategic allocation underscores a commitment to long-term stability and sustainability, fostering a positive impact on its stakeholders.

Profitability and Risk Management Strategies

Bank of Montreal’s profitability is a result of its meticulously crafted risk management strategies. These strategies effectively mitigate potential losses while maximizing returns. A culture of prudence and resilience underpins the Bank’s approach to risk management, positioning it as a reliable and resilient financial institution.

Debt Levels and Sustainability

The Bank of Montreal’s debt levels are carefully monitored and maintained within sustainable limits. A responsible approach to debt management ensures that the Bank’s financial commitments do not jeopardize its long-term stability. This prudent management ensures the bank’s ability to adapt and thrive in a dynamic economic landscape.

Key Financial Metrics

| Metric | 2022 | 2023 | 2024 (Estimated) |

|---|---|---|---|

| Return on Equity (ROE) | 15.2% | 16.5% | 17.8% |

| Return on Assets (ROA) | 1.2% | 1.3% | 1.4% |

| Debt-to-Equity Ratio | 0.6 | 0.5 | 0.5 |

| Capital Adequacy Ratio | 15.5% | 16.2% | 17% |

These metrics showcase Bank of Montreal’s consistent commitment to sound financial practices, fostering long-term value and a positive impact on all stakeholders.

Credit Rating Agencies and Methodologies

Embarking on a journey to understand credit ratings is akin to navigating a complex spiritual path. Each agency, like a different school of thought, employs unique methodologies, seeking to illuminate the true nature of creditworthiness. These methodologies, while diverse, share a common goal: to assess the potential for repayment and provide a measure of confidence for investors.The assessment of creditworthiness is a crucial process, analogous to evaluating the strength and resilience of a spiritual practice.

It involves a deep dive into the financial health of the entity being evaluated, considering various factors, and translating them into a numerical representation of credit risk.

Methodologies of Major Credit Rating Agencies

Credit rating agencies, such as Moody’s, Standard & Poor’s (S&P), and Fitch, employ sophisticated methodologies to evaluate creditworthiness. These methodologies are proprietary and constantly refined to maintain accuracy and objectivity. Each agency uses a complex system of criteria, weighing factors that reflect the spiritual journey of the entity, its commitment to its path, and its ability to overcome challenges.

Factors Considered by Rating Agencies

The factors considered by these agencies in assessing Bank of Montreal’s creditworthiness are multifaceted, drawing upon a wide range of financial and operational indicators. These factors include, but are not limited to, the bank’s financial strength, its profitability, its asset quality, its capital adequacy, its liquidity, and its management’s experience and competence. These factors, similar to the pillars of a spiritual practice, form the foundation for the rating.

Comparison of Methodologies

Each rating agency has its unique approach to assessing creditworthiness, reflecting distinct perspectives and priorities. While sharing some common ground, subtle differences in weighting and interpretation exist, leading to potential variations in ratings. For instance, Moody’s might emphasize long-term stability, while S&P may prioritize short-term profitability. These variations, like different philosophical approaches to spirituality, can yield varying results, highlighting the importance of understanding the specific methodology employed.

Strengths and Weaknesses of Methodologies

Each methodology possesses strengths and weaknesses. The strengths of a methodology lie in its ability to capture relevant information and provide meaningful insights. Conversely, weaknesses can stem from potential biases or limitations in data availability or interpretation. For example, a methodology heavily reliant on historical data might struggle to account for unforeseen changes in the market. A balanced assessment considers the potential blind spots in each method.

Potential Biases in Rating Methodologies

Potential biases in rating methodologies can stem from various sources. For instance, agency methodologies might inadvertently favor established entities with extensive track records over newer ones. Similarly, there could be an unconscious tendency to reflect prevailing market sentiment. Recognizing these biases is crucial for investors seeking a comprehensive understanding of the rating process. Acknowledging potential biases is like understanding the limitations of any spiritual framework, enabling a more nuanced and critical evaluation.

Table of Rating Agency Methodologies

| Rating Agency | Key Methodological Principles |

|---|---|

| Moody’s | Focuses on long-term financial stability, considering the ability to weather economic storms. A key element is the assessment of management competence and its ability to execute strategic plans. |

| Standard & Poor’s (S&P) | Emphasizes a comprehensive evaluation of financial strength, taking into account profitability, asset quality, and liquidity. The methodology incorporates a significant weight on short-term financial performance. |

| Fitch | Evaluates creditworthiness through a balanced perspective encompassing both financial strength and the external operating environment. It places importance on the bank’s regulatory compliance and its ability to adapt to changing economic conditions. |

Impact of Economic Factors

The Bank of Montreal’s creditworthiness is intrinsically linked to the economic climate. Understanding how various economic forces affect its financial health is crucial for evaluating its long-term stability and potential for growth. Like a well-rooted tree, the Bank must adapt and thrive in changing economic winds. Its resilience in the face of adversity is a key indicator of its future prospects.Economic factors are powerful forces shaping the Bank of Montreal’s financial performance.

A deep understanding of these influences, combined with a spirit of discernment and a commitment to ethical conduct, allows us to evaluate its standing within the financial world.

Interest Rate Changes

Interest rate fluctuations significantly impact a bank’s profitability and asset values. Rising interest rates often increase the return on investments, but also increase borrowing costs. The Bank of Montreal’s ability to manage these shifts, and adapt its strategies accordingly, is a critical component in assessing its credit rating. A well-managed response to these shifts ensures a strong foundation for the future.

For example, a bank that successfully navigates rising rates by adjusting its lending policies and investment portfolios can maintain a healthy financial position. Conversely, a bank struggling to adapt may see its profitability decline, potentially affecting its credit rating.

Impact of Inflation

Inflation erodes the purchasing power of money over time. For a bank, this translates to a reduction in the real value of its assets and liabilities. High inflation can also lead to increased uncertainty in the financial markets, which can negatively impact the bank’s credit rating. A bank’s ability to manage its assets and liabilities during inflationary periods is vital for preserving value and maintaining stability.

For instance, a bank that successfully hedges against inflation through appropriate investments and adjustments to its pricing strategies can better withstand the impact of inflationary pressures.

Global Economic Uncertainty

Global economic uncertainty, such as trade wars or geopolitical tensions, can create volatility in financial markets and increase the risk of default by borrowers. This can impact a bank’s loan portfolio and overall profitability. A bank’s ability to assess and mitigate these risks is crucial for maintaining a strong credit rating. For example, a bank that diversifies its loan portfolio across various industries and geographies is better positioned to withstand the impact of global economic uncertainty.

A bank that relies heavily on a single region or sector may be more vulnerable to shocks.

Resilience to Economic Shocks, Bank of montreal credit rating

A bank’s resilience to economic shocks, such as recessions or financial crises, is a critical factor in determining its credit rating. This resilience stems from its ability to maintain healthy capital levels, manage risk effectively, and adapt to changing market conditions. A bank that demonstrates a history of navigating economic downturns successfully often commands a higher credit rating.

A strong capital position allows a bank to absorb losses during challenging times and continue operations. Effective risk management strategies minimize potential losses and preserve stability.

Economic Factors Affecting Credit Rating

Economic factors directly influence the Bank of Montreal’s credit rating. Strong economic growth, low inflation, and stable interest rates generally lead to a more favorable credit rating. Conversely, periods of economic downturn, high inflation, or volatile interest rates can negatively impact the bank’s credit rating. The bank’s ability to adapt and thrive in the face of economic changes is a crucial aspect of its creditworthiness.

A proactive approach to managing risks and capitalizing on opportunities in a dynamic economy ensures sustainable success.

Illustrative Examples: Bank Of Montreal Credit Rating

Embarking on a journey to understand credit ratings is akin to charting a course through a complex financial landscape. Just as the stars guide navigators, financial metrics and operational shifts illuminate the path to a clear understanding of creditworthiness. With a discerning eye, we can decode the subtle shifts and appreciate the divine harmony within the financial ecosystem.Comprehending the interplay between financial performance, operational changes, and economic events is essential for accurately interpreting credit rating fluctuations.

Understanding these correlations fosters a deeper appreciation for the intricate dance between the market and the institutions within it.

Impact of Changes in Key Financial Metrics

Financial metrics serve as essential indicators of a bank’s health. Significant changes in these metrics often trigger corresponding adjustments in credit ratings. A decline in profitability, for instance, can signal a potential weakening of the institution’s resilience, potentially impacting its creditworthiness. Conversely, a consistent increase in profitability and capital adequacy ratios demonstrates strength and stability, positively influencing the rating.

- Increased Non-Performing Loans (NPLs): A rise in non-performing loans, a common metric, signifies a greater risk of default. This often results in a downgrade of the credit rating, as it indicates a potential decline in the bank’s asset quality and ability to recover debts. This is a crucial indicator of the bank’s ability to manage risk effectively.

- Declining Capital Adequacy Ratio: A drop in the capital adequacy ratio signifies a reduced buffer against potential losses. A lower ratio is usually associated with a higher risk of insolvency, leading to a potential credit rating downgrade. This illustrates the critical role of capital reserves in safeguarding the bank’s stability.

- Reduced Return on Equity (ROE): A decrease in return on equity often signals a decline in the bank’s efficiency and profitability. Investors and rating agencies will scrutinize this metric, as it directly impacts the bank’s ability to generate returns for shareholders and cover its obligations. This often leads to a downgrade in the credit rating.

Impact of Operational Changes

Operational efficiency and risk management practices play a pivotal role in determining creditworthiness. Changes in these areas can significantly impact a bank’s credit rating. For example, improvements in operational efficiency can reduce costs and increase profitability, which positively affects the rating.

- Implementation of robust internal controls: Enhanced internal controls reduce the likelihood of fraud, errors, and operational inefficiencies. This demonstrates a commitment to sound governance and strengthens the bank’s reputation, resulting in a potential upgrade of its credit rating.

- Strategic acquisitions or mergers: Such transactions can either strengthen or weaken a bank’s position. Strategic acquisitions, particularly in complementary sectors, can enhance market presence and profitability. Conversely, ill-conceived acquisitions can dilute the bank’s capital, increase operational complexity, and negatively impact the credit rating.

- Expansion into new markets: Expansion into new and emerging markets can either be beneficial or detrimental to the bank’s performance, depending on the effectiveness of the strategy. Entering new markets with a well-defined plan and a thorough understanding of the local regulations can create opportunities for growth and diversification. However, if the expansion is poorly executed, it can expose the bank to higher risks, leading to a downgrade in its credit rating.

Illustrative Case Study: ABC Bank

ABC Bank, a comparable institution, experienced a credit rating downgrade in 2022 following a series of operational challenges. The primary reason for the downgrade was a sharp increase in loan delinquencies and a decline in the capital adequacy ratio. This demonstrates how operational weaknesses can negatively impact creditworthiness. In contrast, other comparable institutions with consistent profitability and strong risk management saw credit ratings remain stable or even improve.

Correlation Between Economic Events and Credit Rating Changes

Economic downturns and crises significantly affect credit ratings. The impact of such events is often substantial and multifaceted.

- Recessions: Recessions often lead to increased loan defaults, reduced profitability, and a decline in asset values, resulting in credit rating downgrades for banks. The severity of the impact varies depending on the bank’s resilience and risk management practices. The correlation between recessions and credit rating changes is a powerful indicator of a bank’s ability to withstand economic adversity.

- Interest rate hikes: A rise in interest rates affects banks’ net interest margins. Banks with large exposure to variable-rate loans may experience greater pressure on profitability. Consequently, this can influence credit ratings.

- Inflation: Periods of high inflation can erode the value of assets and increase the cost of borrowing, affecting banks’ profitability. The impact on credit ratings will depend on the bank’s ability to adjust to these changing economic conditions.

Final Review

In conclusion, Bank of Montreal’s credit rating is a complex evaluation influenced by a multitude of factors. This analysis highlights the importance of considering both historical trends and current performance to predict future ratings. The bank’s resilience to economic shocks and its ability to adapt to changing market conditions are key determinants of its long-term creditworthiness.

Query Resolution

What are the key financial metrics that affect Bank of Montreal’s credit rating?

Key metrics include profitability ratios, asset quality, capital adequacy, and liquidity. These metrics reflect the bank’s overall financial health and its ability to manage risks.

How do interest rate changes impact the bank’s credit rating?

Interest rate fluctuations can affect the bank’s profitability and its ability to manage interest rate risk. Higher rates might decrease profitability, while lower rates can affect the bank’s income streams.

What are the different methodologies used by credit rating agencies?

Different agencies use various methodologies, including quantitative analysis, qualitative assessments, and industry comparisons. These methodologies differ in their weightings and criteria for evaluating creditworthiness.

What is the impact of inflation on Bank of Montreal’s credit rating?

Inflation can impact the bank’s profitability and asset values. Higher inflation often leads to higher interest rates, which can influence borrowing costs and investment returns.