Will insurance cover hair transplant? This question haunts many considering this procedure. The answer, unfortunately, isn’t a simple yes or no. It’s a complex interplay of factors, including the specific insurance plan, the medical necessity claim, and the provider’s interpretation of the procedure’s classification.

This comprehensive guide delves into the intricacies of insurance coverage for hair transplants, exploring the nuances of different insurance plans, the critical role of medical necessity, and the essential steps to navigate the process effectively. We’ll unravel the common misconceptions, examine the influencing factors, and equip you with the knowledge to make informed decisions.

Introduction to Hair Transplant Insurance Coverage

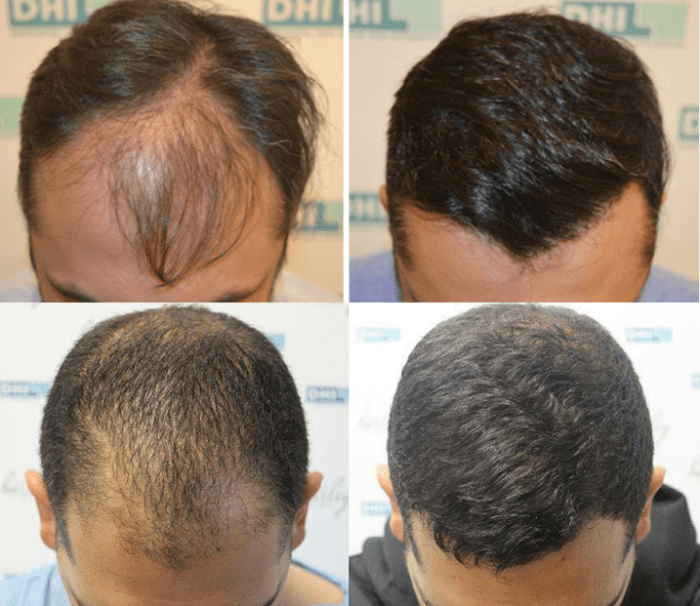

A hair transplant, a procedure meticulously crafted to restore a fuller head of hair, involves the careful extraction and implantation of hair follicles. This intricate process, often requiring multiple sessions, aims to achieve a natural-looking result. It is a significant investment, both financially and emotionally, for those seeking this solution. Understanding insurance coverage is crucial for navigating the financial aspects of this procedure.Common misconceptions often cloud the issue of insurance coverage for cosmetic procedures.

Many believe that all cosmetic procedures are automatically excluded from coverage. However, the reality is more nuanced, as it hinges on the specific nature of the procedure and the stipulations of the individual insurance plan. This distinction between cosmetic and medically necessary procedures is paramount in determining coverage. Furthermore, the criteria for medical necessity often vary greatly, making it imperative to review policy details carefully.

Distinguishing Cosmetic and Medically Necessary Procedures

The critical distinction lies in whether the procedure addresses a medical condition or primarily enhances appearance. A hair transplant aimed at addressing significant hair loss related to a medical condition (e.g., alopecia) might qualify as medically necessary, while a transplant primarily focused on achieving a more aesthetically pleasing result would be classified as cosmetic. The medical necessity determination is typically made by the insurance provider, based on the specific diagnosis and the physician’s recommendation.

It is not uncommon for insurance providers to require documentation from a physician specializing in the condition, including a detailed medical report explaining the rationale for the transplant procedure.

Comparison of Insurance Plan Policies on Cosmetic Procedures

Understanding the policies of various insurance plans is crucial in assessing the potential coverage for a hair transplant. The level of coverage can differ significantly between plans.

| Insurance Plan Type | Typical Policy on Cosmetic Procedures | Coverage Details | Example Scenario |

|---|---|---|---|

| HMO | Usually limited or no coverage | HMO plans typically have extensive exclusions for cosmetic procedures. This often includes hair transplants, unless there is a demonstrable medical necessity for the procedure. | A patient with mild hair thinning seeking a hair transplant for aesthetic reasons would likely face no coverage under an HMO plan. |

| PPO | Potentially more flexible coverage | PPO plans may offer more flexibility in coverage for cosmetic procedures compared to HMO plans. However, coverage is still contingent on meeting specific criteria for medical necessity. The patient will have to be clear about the reason for the transplant procedure. | A patient with significant hair loss related to a diagnosed medical condition, seeking a hair transplant under a PPO plan, might have a better chance of coverage. |

| Medicare/Medicaid | Generally, no coverage | Both Medicare and Medicaid plans, typically, do not cover cosmetic procedures. Hair transplants are usually not considered medically necessary, and therefore are not covered. | An individual enrolled in Medicare or Medicaid seeking coverage for a hair transplant for aesthetic purposes will likely not receive coverage. |

Factors Influencing Insurance Decisions

Insurance companies meticulously assess coverage requests for hair transplants, considering a multifaceted approach to ensure responsible allocation of funds. This careful evaluation is crucial for maintaining financial stability and ensuring that coverage is granted only to those truly needing the procedure. The decisions are not arbitrary but are grounded in established medical principles and policy guidelines.Medical necessity plays a significant role in determining whether a hair transplant will be covered by insurance.

The decision is not simply based on the desire of the patient but on whether the procedure addresses a genuine medical condition. Insurance companies aim to support those who require the procedure for therapeutic reasons, and the medical necessity is paramount in this assessment.

Medical Necessity Evaluation

Insurance companies evaluate the severity and nature of hair loss to determine if a transplant is medically necessary. Conditions like androgenetic alopecia (male pattern baldness) and alopecia areata are considered when assessing the need for intervention. The extent of the hair loss, its impact on the patient’s psychological well-being, and the potential for future complications are also carefully considered.

A thorough evaluation of medical records, including prior treatment attempts and consultation reports, is vital.

Determining if insurance will cover a hair transplant often hinges on specific policy details. Factors like pre-existing conditions and the extent of the procedure can significantly impact coverage. For financial planning, researching local banks, like first resource bank st croix falls wi , can provide valuable insight into financing options. Ultimately, consulting with an insurance provider and potentially a medical professional is crucial to understand your specific coverage for hair transplant procedures.

Role of Pre-authorization and Pre-operative Consultations

Pre-authorization is a critical step in the insurance coverage process. Insurance companies often require pre-authorization before approving any medical procedure. This allows the insurer to review the proposed treatment plan and ensure it aligns with their coverage guidelines. Pre-operative consultations are essential for providing further evidence of medical necessity and assessing the suitability of the proposed surgical intervention.

These consultations provide the opportunity to address any concerns and ensure the patient is a suitable candidate for the procedure.

Importance of Patient’s Medical History

The patient’s complete medical history is thoroughly examined to identify any pre-existing conditions that might influence the procedure or create complications. This includes any allergies, medications, or underlying health issues that could affect the outcome of the hair transplant or necessitate specific precautions during the procedure. A thorough understanding of the patient’s health status allows for a more informed decision regarding the suitability of the procedure.

Table of Factors Influencing Insurance Coverage Decisions

| Factor | Explanation | Impact on Coverage | Example |

|---|---|---|---|

| Medical Necessity | The procedure must address a genuine medical condition, not just aesthetic concerns. | High probability of coverage if strongly supported by medical documentation. | Severe alopecia areata requiring significant hair restoration. |

| Pre-authorization | Insurance companies require prior approval before covering a procedure. | Essential step; failure to obtain pre-authorization can result in denial of coverage. | Patient submits pre-authorization request and obtains approval from the insurance company before the procedure. |

| Pre-operative Consultations | Consultations with specialists to confirm the necessity and suitability of the procedure. | Demonstrates a thorough evaluation and strengthens the case for medical necessity. | Detailed consultations with dermatologists and surgeons regarding hair loss treatment options. |

| Patient’s Medical History | Review of the patient’s complete medical history, including pre-existing conditions. | Identifying potential risks or complications and ensuring appropriate precautions are taken. | Patient with a history of bleeding disorders requires careful consideration before a hair transplant. |

Legal and Ethical Considerations

Insurance coverage for hair transplant procedures, like other elective cosmetic procedures, navigates a complex landscape of legal and ethical considerations. Understanding these nuances is crucial for both patients and insurance providers to ensure fair and equitable practices. The varying interpretations of what constitutes a medically necessary procedure versus a purely cosmetic one can lead to disputes.The legal framework governing cosmetic procedures and their insurance coverage differs significantly across jurisdictions.

A nuanced understanding of these variations is vital for both parties to avoid misunderstandings and potential legal ramifications. Furthermore, ethical considerations surrounding insurance coverage for elective procedures necessitate a careful evaluation of societal values and the potential impact on the overall healthcare system.

Legal Requirements Related to Cosmetic Procedures and Insurance Coverage

Insurance companies are bound by legal requirements to uphold transparency and fairness in their coverage decisions. These requirements often stipulate that procedures must meet specific criteria to qualify for coverage. These criteria usually involve the procedure’s necessity for treating a pre-existing medical condition, rather than purely cosmetic enhancement. Failure to adhere to these legal standards can result in legal action.

Ethical Considerations Regarding Insurance Coverage for Elective Procedures

Ethical considerations surrounding elective procedures, such as hair transplants, often center on the concept of medical necessity versus patient preference. The balance between patient autonomy and the need for insurance resources to be allocated responsibly requires careful consideration. Insurance companies must consider not only the medical necessity of the procedure but also the broader societal implications of widespread coverage for elective procedures.

Patient’s Role in Obtaining Pre-Authorization

Patients play a critical role in the pre-authorization process for hair transplant procedures. They must diligently provide all necessary medical documentation and information to support their claim for insurance coverage. This includes providing detailed medical histories, diagnosis reports, and any relevant supporting documentation from a healthcare professional, to help establish the procedure’s necessity, if applicable. Failure to provide accurate and complete information can significantly impact the outcome of the pre-authorization process.

Potential Legal Ramifications of Misleading Claims or Misrepresentations

Misleading claims or misrepresentations regarding the necessity of a hair transplant procedure can have severe legal repercussions for both the patient and the healthcare provider. Insurance companies are equipped with sophisticated mechanisms to detect and investigate potential fraud or misrepresentation. In cases where intentional misrepresentation is proven, penalties can include denial of claims, fines, and even legal action.

Patients and providers must be mindful of the potential legal implications of any false or misleading statements made during the pre-authorization process.

Relevant Laws and Regulations Related to Cosmetic Procedures

- State and federal laws governing insurance practices and procedures are crucial to understanding the specific requirements for coverage. These laws often include provisions addressing the definition of medical necessity, pre-authorization procedures, and dispute resolution mechanisms.

- Laws pertaining to cosmetic procedures often vary from state to state, with some jurisdictions having more stringent regulations than others. Understanding these variations is essential for both patients and healthcare providers. These regulations can dictate what is considered a cosmetic procedure and the level of documentation required for coverage.

Insurance Provider Specifics

Insurance coverage for hair transplants varies significantly among providers, reflecting the complex and often nuanced nature of medical procedures. These variations are not merely regional; they are deeply rooted in the individual policies and philosophies of each insurer. Understanding these differences is crucial for individuals considering a hair transplant, enabling them to make informed decisions aligned with their financial realities.

Factors like pre-authorization requirements, reimbursement rates, and specific exclusions play a pivotal role in the final cost and accessibility of the procedure.Different insurance providers approach hair transplant coverage with varying degrees of generosity. Some insurers might have a more comprehensive policy that covers a larger portion of the procedure, while others might have a more restrictive approach, limiting coverage or outright excluding it.

This discrepancy underscores the importance of thorough research and careful examination of individual policy details.

Variations in Coverage Policies Among Different Insurance Providers

Insurance policies often differ in their specific terms regarding coverage for hair transplants. Some providers might cover the procedure under specific circumstances, such as medically necessary cases. Others might require pre-authorization, further complicating the process. The amount of coverage can also vary substantially, from a small percentage to a significant portion of the procedure’s cost. These discrepancies stem from differing interpretations of medical necessity, differing reimbursement rates, and unique policy provisions.

Comparison of Coverage Policies Across Various States

State-level regulations and laws can influence insurance coverage policies for hair transplants. In some states, insurers might be required to cover medically necessary procedures, which can encompass hair transplants in certain situations. However, other states may not have such mandates, leaving the coverage decision entirely up to the discretion of the individual insurance provider. Consequently, a thorough understanding of state-level regulations is essential when assessing potential coverage for hair transplants.

Detailed Overview of Common Exclusions and Limitations

Many insurance policies include exclusions and limitations concerning hair transplant coverage. These limitations frequently stem from the perceived cosmetic nature of the procedure. Some policies may exclude hair transplants entirely, viewing them as primarily elective procedures. Other policies might cover only a portion of the procedure if deemed medically necessary, such as for cases of severe hair loss associated with a medical condition.

Determining if insurance covers hair transplants can be tricky, as coverage varies significantly. Factors like pre-existing conditions and the specific policy at 124 princes street port melbourne often influence decisions. Ultimately, consulting with your insurer or a medical professional is crucial to understanding your specific coverage for procedures like hair transplants.

Limitations often include pre-authorization requirements, specific types of hair transplant techniques, or restrictions on the number of sessions.

Table of Insurance Provider Coverage Policies

| Insurance Provider | Coverage Policy | Exclusions | Limitations |

|---|---|---|---|

| Company A | Covers 50% of the procedure if deemed medically necessary by a specialist and pre-authorization is obtained. | Procedures performed for purely cosmetic reasons. | Pre-authorization required; Maximum coverage capped at USD 5,000; Only certain techniques are covered. |

| Company B | Covers 80% of the procedure if pre-authorization is granted and the procedure is performed by a board-certified surgeon. | Procedures performed for cosmetic purposes without a diagnosed medical condition. | Requires a physician’s written statement justifying the medical necessity; Coverage for a maximum of 2 sessions. |

| Company C | Covers 100% of the procedure if performed to treat a condition related to alopecia areata, and a pre-authorization is obtained. | Procedures not deemed medically necessary. | Procedures must be performed by a board-certified surgeon with a demonstrated history of successful cases. |

Case Studies and Examples: Will Insurance Cover Hair Transplant

Navigating the intricate world of hair transplant insurance claims often resembles a journey through a dense jungle. Success depends on meticulous preparation, clear communication, and a thorough understanding of the process. Understanding real-life examples, both triumphant and challenging, can illuminate the path and equip individuals with the knowledge needed to navigate this complex landscape effectively.

Successful Claims

Successful claims hinge on a comprehensive understanding of the medical necessity of the procedure. Insurance companies often require a detailed explanation of the medical reasons behind the hair transplant. A robust medical history, including photographs documenting hair loss and its impact on the patient’s life, is critical. Pre-authorization requests, meticulously prepared with detailed documentation, significantly enhance the chances of approval.

The documentation should clearly demonstrate that the procedure is medically necessary, not a cosmetic enhancement. These elements collectively pave the way for successful claims.

Unsuccessful Claims

Insurance denials often stem from a lack of proper pre-authorization or insufficient documentation. The medical necessity for the procedure needs to be convincingly demonstrated. Patients must present comprehensive documentation, including medical records, photographs, and a detailed explanation of the procedure’s rationale. A clear understanding of the insurance company’s specific criteria and requirements is essential. Failure to meet these standards can lead to claim denials.

Appealing Denied Claims

Appealing a denied claim necessitates a strategic approach. Understanding the specific reasons for the denial is crucial. Thorough review of the initial denial letter, identification of any gaps in the original submission, and the proactive collection of supplementary documentation are key steps. Patients should consult with legal professionals or insurance advisors specializing in medical claims. Presenting compelling evidence, addressing the specific concerns Artikeld in the denial letter, and meticulously demonstrating the medical necessity of the procedure are paramount.

Common Reasons for Claim Denials

- Insufficient medical necessity: The insurance company may not consider the hair loss a medically necessary condition, but rather a cosmetic issue.

- Inadequate pre-authorization: Missing or incomplete pre-authorization requests, failing to follow the required procedures, and lacking a thorough explanation of the medical necessity are common pitfalls.

- Lack of supporting documentation: Missing or incomplete medical records, insufficient photographs documenting hair loss, and absence of a detailed rationale for the procedure can lead to denial.

- Failure to meet specific criteria: Insurance companies often have stringent criteria regarding medical necessity. Failure to adhere to these criteria can lead to claim denials.

Pre-Authorization Requests and Documentation

A pre-authorization request is a crucial step in the process, often acting as a roadmap for the claim. It serves as a formal request to the insurance company for approval of the procedure. The request must be meticulously completed, providing detailed information about the procedure, its medical necessity, and expected costs. The documentation should include a letter from the physician outlining the rationale for the procedure, including the patient’s medical history, diagnosis, and treatment plan.

It is also essential to provide photographs, medical records, and other relevant documentation to support the claim.

Gathering Necessary Documentation

A well-prepared case is essential for a successful claim. Gather all relevant medical records, including doctor’s notes, diagnoses, and treatment plans. Collect comprehensive photographs documenting the extent of hair loss and its impact on the patient. Ensure a detailed letter from the physician outlining the rationale for the procedure, along with a clear explanation of the medical necessity and the expected outcome.

The patient’s medical history and any relevant information should also be included. This comprehensive collection of documents will strengthen the claim.

Patient’s Rights and Responsibilities

Patients seeking insurance coverage for hair transplants possess inherent rights that must be understood and upheld. These rights encompass the right to fair and transparent treatment by insurance providers, as well as the right to clear and accessible information regarding coverage policies. A thorough understanding of these rights, coupled with a responsible approach, ensures a smoother process for obtaining necessary coverage.

Patient Rights When Seeking Insurance Coverage, Will insurance cover hair transplant

Patients have the right to a comprehensive understanding of their insurance policy’s stipulations concerning hair transplant procedures. This includes clarity on specific coverage details, exclusions, and any pre-authorization requirements. A patient should feel empowered to ask questions and receive straightforward answers. Further, they have the right to appeal decisions regarding coverage denials and to receive detailed explanations for those denials.

Patient Responsibilities in the Insurance Coverage Process

Patients have responsibilities that are integral to the successful pursuit of insurance coverage. These responsibilities include meticulously documenting all relevant medical information and maintaining clear communication with their insurance provider. Thorough record-keeping and clear communication are essential for a smooth process. Furthermore, patients should promptly address any requests for additional documentation from their insurance provider.

Importance of Clear Communication with Insurance Providers

Effective communication with insurance providers is paramount in securing hair transplant coverage. Patients must be proactive in seeking clarification on policy details, asking questions, and documenting all interactions. This proactive approach can prevent misunderstandings and potential delays. Patients should maintain accurate records of all communications and correspondences.

Questions Patients Should Ask Before the Procedure

Patients should carefully consider the following questions prior to undergoing a hair transplant procedure:

- What are the specific coverage guidelines for hair transplants, including pre-authorization requirements?

- What is the estimated cost of the procedure, and how much will the insurance cover?

- What are the potential exclusions or limitations in coverage, and what are the criteria for a coverage denial?

- What is the appeals process if the insurance company denies coverage, and what is the timeframe for appealing a decision?

- Are there any specific medical requirements or pre-operative assessments necessary for the insurance to cover the procedure?

These inquiries ensure a comprehensive understanding of the procedure’s financial implications and insurance coverage before proceeding.

Understanding and Interpreting Insurance Policy Documents

Insurance policy documents can be complex, often containing jargon and technical language. Patients should not hesitate to seek professional guidance to interpret these documents. This might include a financial advisor or legal counsel to ensure a clear understanding of their rights and responsibilities. Furthermore, consulting with a healthcare professional experienced in navigating insurance policies can be invaluable.

By taking this proactive approach, patients can confidently make informed decisions.

Alternative Funding Options

Securing a hair transplant can be a significant financial undertaking. When insurance coverage is limited or unavailable, exploring alternative funding options becomes crucial for many individuals seeking this procedure. Understanding these options and their implications can empower potential patients to make informed decisions aligned with their financial circumstances.Exploring various financing avenues is a proactive step in the journey toward achieving a desired aesthetic outcome.

Carefully evaluating the terms, conditions, and potential drawbacks of each option is essential for making a sound financial choice. This process should consider not only the immediate costs but also the long-term implications of repayment schedules and interest rates.

Financing Options for Hair Transplants

Various financing options are available to individuals who require financial assistance for hair transplants. These options offer diverse approaches to funding the procedure, catering to varying financial situations and preferences.

Personal Loans

Personal loans can be a viable option for covering the cost of a hair transplant. These loans often come with fixed interest rates and repayment terms, providing a predictable financial structure. However, eligibility depends on individual creditworthiness, and the interest rates can vary significantly. Borrowers should thoroughly compare loan terms from different financial institutions to ensure the most favorable agreement.

A detailed review of interest rates, repayment schedules, and associated fees is crucial for making an informed decision. For example, a personal loan with a lower interest rate and a longer repayment period might be more suitable for individuals with limited disposable income.

Medical Credit

Medical credit specifically designed for cosmetic procedures can offer attractive repayment options, tailored to the unique needs of the procedure. These programs typically feature flexible repayment plans and may offer lower interest rates compared to traditional personal loans. The availability and terms of medical credit can vary depending on the provider. Understanding the fine print and comparing different options is essential for individuals seeking this financing option.

It is vital to compare the interest rates, repayment periods, and any hidden fees associated with medical credit programs.

Government Grants and Subsidies

Some governments or organizations offer grants or subsidies for medical procedures, including hair transplants, for specific populations or in certain circumstances. Investigating these options can lead to significant cost reductions for eligible individuals. The availability and eligibility criteria for these grants can vary significantly by location and specific circumstances.

Comparison of Funding Options

| Funding Option | Pros | Cons | Eligibility Criteria |

|---|---|---|---|

| Personal Loans | Fixed interest rates, predictable repayment schedule | Interest rates can vary, eligibility depends on creditworthiness | Good credit history, ability to meet loan obligations |

| Medical Credit | Flexible repayment plans, potentially lower interest rates | Interest rates and terms may vary, need to thoroughly compare | Meeting specific eligibility requirements of the credit provider |

| Government Grants/Subsidies | Significant cost reduction, potential for free or reduced-cost procedures | Limited availability, stringent eligibility criteria | Meeting specific criteria set by the granting body, such as location, health status, or income |

Last Word

Ultimately, determining whether insurance will cover a hair transplant requires careful consideration of individual circumstances. Understanding the nuances of your insurance policy, the medical necessity criteria, and the potential alternative funding options are paramount. This guide has hopefully provided a clear roadmap for navigating this complex process, empowering you to make the best choices for your situation.

Essential Questionnaire

Does insurance cover all cosmetic procedures?

No. Insurance coverage for cosmetic procedures is often limited or nonexistent. The procedure’s classification as medically necessary, rather than purely cosmetic, greatly impacts coverage decisions.

What is the role of pre-authorization in insurance claims?

Pre-authorization is crucial. Insurance companies require pre-authorization to evaluate the medical necessity of the procedure. Failure to obtain pre-authorization often leads to claim denial.

What are common reasons for insurance claim denials for hair transplants?

Common reasons for denial include the procedure being deemed cosmetic, insufficient medical necessity justification, lack of pre-authorization, and inadequate supporting documentation. Misrepresenting the procedure’s nature can also lead to denial.

What alternative funding options exist for hair transplants?

Alternative funding options include personal loans, medical credit, or financing plans offered by the clinic. Each option has its own pros and cons in terms of interest rates, repayment schedules, and eligibility criteria.